Orange County

Our mission is to save lives by meeting the most critical needs of our communities and investing in breakthrough research to prevent and cure breast cancer.

Orange County

Our mission is to save lives by meeting the most critical needs of our communities and investing in breakthrough research to prevent and cure breast cancer.

Need Help?

Call our breast care helpline to assist with finding local screening and diagnostic facilities or clinical research trials, requesting financial assistance, or other questions or care needs.

Get Involved

Help us reach our vision of a world without breast cancer by getting involved in our local community.

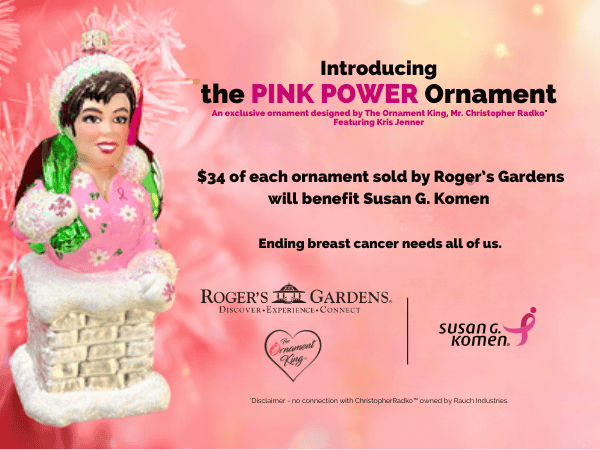

Introducing the PINK POWER ornament – Available now through May 30,2024

PINK POWER is an exclusive ornament crafted by The Ornament King, Mr. Christopher Radko* featuring Kris Jenner. Each ornament is handmade by skilled artisans in Poland and sold exclusively at RogersGarden.com.

Don’t miss out! Order yours now through May 30, 2024.

A special thanks to Roger’s Garden, The Ornament King, & Kris Jenner for their support of Komen’s mission.

*Disclaimer – no connection with ChristopherRadko™ owned by Rauch Industries.

Order Today

Join us at the Angels game this upcoming Mother’s Day

In recognition of Mother’s Day, we will be honoring the fight against breast cancer alongside the Angels.

Join us on Sunday, May 12, and bring the whole family along with your best pink gear as we turn Angel Stadium pink in honor of moms everywhere.

Use the link below to purchase your discounted tickets. A portion of the proceeds from every ticket sold through this special event link will benefit Susan G. Komen.

Get Your Tickets

Get Involved in 2024!

We have a variety of opportunities for individuals, groups, and companies to get involved in 2024.

Whether it is volunteering, joining one of our committees, participating with your group or starting a FUNraiser, we have something for everyone.

Interested in volunteering at our Walk? Email us at ocvolunteer@komen.org

We are looking for incredible community members to join one of our committees, deepening your connection and helping support our walk. Email Katherine at KLee@komen.org to learn more!

GET INVOLVED IN 2024Local Events

Join the fight to end breast cancer by attending an event in Orange County!

Questions? Contact Us

ShareForCures

Your breast cancer information is as unique as you are. When combined with thousands of other ShareForCures members, you provide scientists with a more diverse set of data to make new discoveries, faster.

Latest News & Information

Janice’s Story: Pain to Passion

To meet Janice Parker is to know the definition of what it means to turn pain into passion. She has lived a life where the topic of breast cancer was never far away. From her mother’s and aunt’s diagnoses – to her own…twice – Janice has found power in her experience. As an advocate for […]

The post Janice’s Story: Pain to Passion appeared first on Susan G. Komen®.

Susan G. Komen® is MLB Together Beneficiary As Baseball Goes to Bat for Moms on Mother’s Day

Campaign Led by MLB Aimed at Raising Breast Cancer Awareness as Susan G. Komen Works to Provide Access to High-Quality Breast Care and Services. In recognition of Mother’s Day on Sunday May 12, Susan G. Komen®, the world’s leading breast cancer organization, will be a beneficiary, along with Stand Up To Cancer, under MLB Together’s […]

The post Susan G. Komen® is MLB Together Beneficiary As Baseball Goes to Bat for Moms on Mother’s Day appeared first on Susan G. Komen®.

Orange County

Contact Us

Susan G. Komen Orange County

Executive Director: Shannon Abeyta

Email: SAbeyta@Komen.org

Phone: 657-999-6561